FAQ

Frequently asked questions

Is a Living Income the same as a Universal Basic Income?

There is no single definition of a Universal Basic Income (UBI), and the idea of a Living Income has many overlaps and similarities with some UBI schemes. At its core, the Living Income is based on the idea of ensuring everyone has enough to live on regardless of circumstance.

But although the Living Income will likely need new universal payments to help reach this goal, its objectives cannot be met through universal payments alone – people’s lives are complicated and varied, and we need support that responds to this. This will require a blended social security system, combining new universal payments with stronger needs-based payments.

Won’t a Living Income, backed by the state, just subsidise bosses who don’t pay enough?

The Living Income will work in tandem with an extension of the real living wage and stronger workers’ rights to raise minimum pay rates. But the truth is, we aren’t going back to a world of full employment and jobs for life. We need the Living Income to make sure people are supported and prepared to periodically take time out to retrain, skill up and find the right job for them. The Living Income is about ensuring we can all feel safe in the knowledge we will be paid well in work and well supported out of work.

Isn’t it better to provide public services rather than cash?

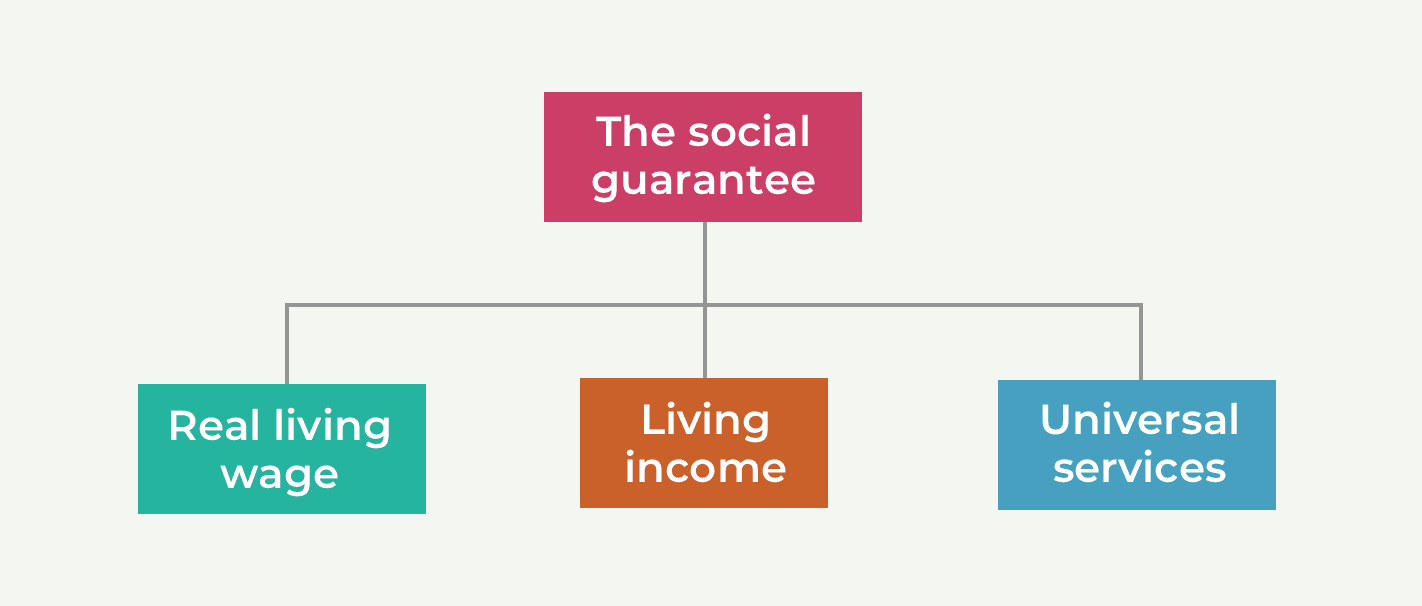

A Living Income and universal public services go hand in hand. Along with the real living wage, they make up what the New Economics Foundation and others call The Social Guarantee – the things we all need to meet our basic needs.

The Social Guarantee enshrines every person’s right to life’s essentials: education, health and social care, a decent home, childcare, nutritious food, clean air and water, energy, transport and access to the internet. For this to happen, people must have access to universal services that meet their needs as well as to a Living Income.

Will it make people lazy?

No. International trials tend to find no impact on the likelihood of welfare recipients undertaking paid employment when social security is increased. The Stockton guaranteed income supported work by removing material barriers to full-time employment and giving recipients the emotional and financial capacity for risk. Before the study, 28% of recipients were in full-time employment; one year later 40% were employed full-time – in the control group these figures were 32% and 37%.

For most of us, providing for our families is a driving force. We want to make sure there is food on the table and a warm, safe roof over our heads. And all too often the social security system holds people back by making them wait for five weeks for support and then not giving the right amount of support to ensure they can absorb shocks and get through difficult times.The Living Income is a bold reimagining of income support, which will actually make work pay and allow people to seize opportunities rather than holding them back.

How will we pay for a Living Income?

In the short-term, during the recovery from Covid, it is right for the government to borrow to strengthen social security spending. The cost of government borrowing is at record lows, and this spending goes back into the economy and creates new jobs and wages, which in turn increase tax receipts.

In the longer term, permanent increases in social security support can be offset by permanent reforms to taxation. We are working with others to produce fully costed proposals, and any tax increases will be designed to ensure those with higher incomes or greater concentrations of wealth pay more.